republic onboarding

Internet Banking

-

Online Banking

-

Welcome to RepublicOnline

-

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

Helps you to build your nest egg

Shape your future

The wise investment instrument

Chequing Accounts

Invest and enjoy the best of both worlds

A value package for persons 49 and over.

Bank FREE, easy and convenient.

Tools & guides

Make an informed decision using our calculators

Help choose the account that’s right for you

Standard banking fees and charges.

-

-

Electronic Banking

-

EBS Products

Pay bills and manage your accounts easily

Access accounts with your OneCard

EBS Products

Be able to accept any credit card payment

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

-

-

Credit cards

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business's potential borrowing repayments

-

-

Mortgages

-

-

Premium Services

- Let's Talk Conversion

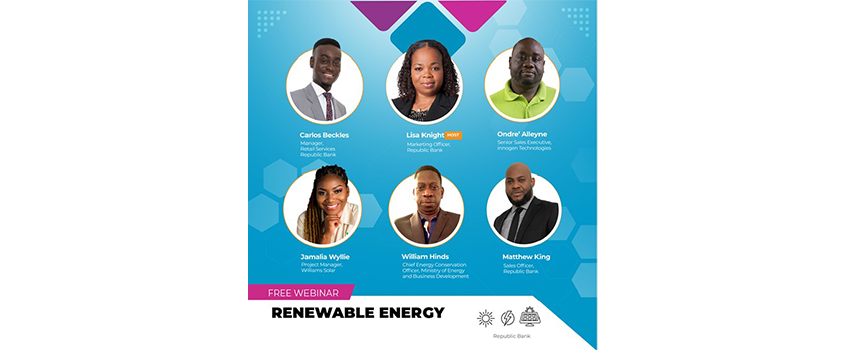

Republic Bank is stepping up its efforts to help create more “green households” in Barbados that are powered by renewable energy.

The Bank’s Manager, Marketing & Corporate Communications, Sophia Allsopp explained, “Our Renewable Energy webinar, held recently and now available online, was a huge success. The large number of participants and the many questions they left with us to follow up on, prove that Barbadians are keen on finding out how they can integrate renewable energy into their homes and businesses.

In keeping with our own goals as signatories to the United Nations Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Banking, we are focused on providing appropriate funding to all Barbadians seeking renewable energy options. Just as we’re supporting the development of more female entrepreneurs and investing in programmes supporting youth in small business enterprises, we are also ramping up our efforts to give more people easier access to renewable energy funding.”

She noted that the Bank will be working with other business leaders and experts to share details about the technologies that are available and the incentives being offered by the government to encourage people to transition to solar energy.

The Webinar was designed to encourage Barbadians to invest in solar power systems and to explain how such investments could help people significantly reduce their electricity bills, earn extra income, and help the island meet its 2030 carbon neutrality goal.

The presenters were Chief Energy Conservation Officer in the Ministry of Energy and Business Development, William Hinds; Senior Sales Executive at Innogen Technologies, Ondre Alleyne; Project Manager at Williams Solar, Jamalia Wyllie; Manager, Retail Services at Republic Bank, Carlos Beckles; and Sales Officer at Republic Bank, Matthew King.

Speaking on the benefits of Republic Bank’s Renewable Energy Loan package, Beckles explained, “Our interest rates are as low as 3.5% - a fantastic rate. It’s the best on the market right now. The 3.5 % interest remains for the entire period of the loan. We do 100% financing, which includes the cost of the system and also the costs associated with installing the system, such as if you need to improve your electrical system. You have up to 15 years to repay and if you repay the system earlier, there is no penalty for early repayment. Any excess funds you get from the system you can apply to the loan as unscheduled principal payment and you can finish the loan faster. So if it’s 15 years and you finish the loan in eight years and they’re guaranteeing 20 years, then that excess 12 years, that cash, comes directly to you.”

He also reminded participants that at Republic Bank, a Renewable Energy Loan is a standalone facility that is not impacted by other loans one might have.

“You can get a Renewable Energy Loan even if you have an existing land loan. They are standalone facilities and the source of repayment is separate. Your land loan is paid from your substantive income while the Renewable Energy Loan is paid from the revenue earned from the energy that is generated from the system that is sold to Barbados Light & Power.

Meanwhile, Hinds noted that the government is offering many incentives to encourage people to invest in solar energy.

“There is an income tax rebate. If you’re importing your solar system yourself rather than going through a company, your value added tax and your import duties are zero. If you are an investor, if you are putting systems on your roof, there are a large number of incentives that the government has put in place over the years. There are so many that we actually have a document full of them that you can download from our website, https://energy.gov.bb/. In terms of government financing, I understand that there are other government agencies that offer programmes that include houses with solar but from the Ministry of Energy and Business Development we have this bucket load of fiscal incentives that allows and encourages people to come on board,” he said.

In the coming months, the Bank will continue initiatives to help Barbadians make informed decisions concerning their transition to solar energy. Interested persons are encouraged to follow the Bank on social media or visit republicbarbados.com for further updates.

Event Calendar

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2026 Republic Bank Limited. All Rights reserved.